Introduction

Picking a SaaS payments and subscription billing platform feels like a checkout decision. It isn’t. It’s an operating model decision.

You’re choosing:

- How money moves (cards, bank debits, wallets)

- Where tax and compliance live

- How much of billing logic sits in your app vs in vendor workflows

- How painful refunds, chargebacks, upgrades, downgrades, and proration will be

Most teams get burned in the same place: they optimize for launch speed, then discover they built a billing system by accident.

Insight: If your billing rules are unclear today, your platform choice won’t fix that. It will just make the ambiguity more expensive.

What this article does:

- Compares Stripe vs Paddle vs Chargebee with the tradeoffs we see in delivery work

- Gives you a decision framework you can defend in a roadmap review

- Shares implementation patterns and what to measure

What it won’t do:

- Pretend there’s a universal winner

- Hide the ugly parts (tax edge cases, failed payments, migrations)

Subsections are where we get specific.

Who this is for

This is for SaaS teams who:

- Sell subscriptions (self serve or sales led)

- Need invoicing, proration, trials, coupons, seat based pricing, or usage based components

- Expect to expand internationally, or already have customers outside their home country

If you’re selling one time digital goods, the calculus changes. But the failure modes are similar.

A quick vocabulary check (so we don’t talk past each other)

- Payments: collecting money (cards, bank transfers, wallets)

- Billing: subscriptions, invoices, proration, credits, dunning

- Merchant of record: who sells to the customer and handles tax compliance

- Dunning: retry logic and comms for failed payments

- Revenue recognition: accounting rules, not just “money in”

What usually breaks in SaaS billing (and why it matters)

Billing rarely fails because the API is down. It fails because your product decisions show up as edge cases.

Common pain points we see when products move past MVP:

- Pricing changes mid contract

- Seat counts that fluctuate daily

- Usage that arrives late (events out of order)

- “Cancel” meaning three different things (end of term, immediate, downgrade)

- Sales discounts that finance can’t reconcile

- Tax rules that suddenly matter once you sell outside one country

Key Stat (hypothesis): In many SaaS teams, billing related work quietly becomes 10% to 20% of engineering time after the first pricing iteration. Measure it by tagging tickets that touch billing, invoices, payments, or tax.

If you’ve read our writing on scaling post MVP, this is the same pattern: early hustle works until it doesn’t. Billing is one of the first systems that punishes “we’ll fix it later.”

Here’s a simple rule of thumb:

- If billing logic is product logic, keep it close to your codebase.

- If billing logic is compliance logic, push it to a vendor.

Subsections below map these failures to platform choices.

The migration tax nobody budgets for

Switching billing platforms is not like swapping analytics.

You’ll touch:

- Customer records and payment methods

- Subscription states and renewal dates

- Invoices, credits, and refunds

- Webhook driven side effects in your app

Mitigation that actually helps:

- Keep a billing domain layer in your app (even if it’s thin)

- Store your own immutable event log of billing state changes

- Treat webhooks as inputs, not truth. Persist and reconcile.

Insight: The best time to design a migration path is before you need it. The second best time is before your first enterprise customer asks for an invoice history export.

International expansion: tax and compliance show up fast

The moment you sell cross border, you’ll run into:

- VAT and GST registration thresholds

- Reverse charge rules

- Local payment methods expectations

- Invoices that must include specific fields

If you don’t have a finance or legal function yet, “merchant of record” becomes less of a buzzword and more of a survival strategy.

featuresGrid

Billing platform fit map:Use this when you need a quick internal recommendation

- Stripe

- Best when: custom pricing, deep product integration, engineering ownership

- Watch for: webhook orchestration, proration edge cases, internal ledger needs

- Paddle

- Best when: global selling early, merchant of record, smaller ops team

- Watch for: constrained flows, customer confusion about seller of record, refund scripts

- Chargebee

- Best when: complex catalog, finance workflows, sales assisted billing

- Watch for: configuration sprawl, too many plan variants, integration overhead

Stripe vs Paddle vs Chargebee: what each platform is really good at

Let’s strip this down.

Baseline Billing Guardrails

Reduce incidents, not features

Most billing incidents we see are self inflicted: duplicate webhooks, access granted before payment clears, or state drifting between systems. Treat these as baseline engineering work:

- Put billing behind a service boundary (even if it is a thin wrapper at first)

- Make every webhook handler idempotent (store event ids, reject duplicates)

- Reconcile billing state on a schedule (do not trust events alone)

- Treat pricing changes as migrations with backfills and audit logs

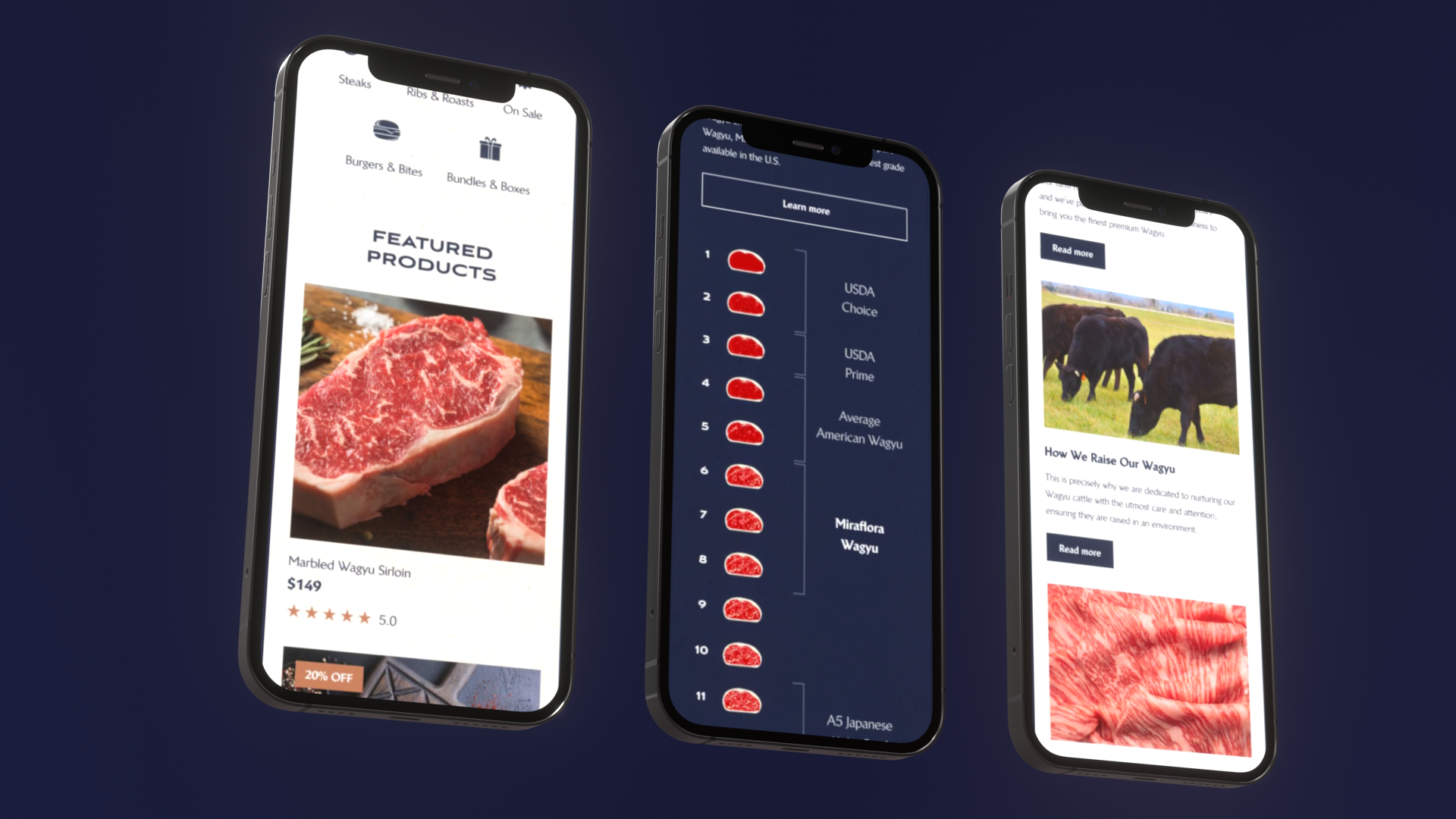

In delivery work (for example, Miraflora Wagyu), speed came from tight scope and clean interfaces. Billing is the same: define the boundary early, then iterate without leaking logic across the app.

- Stripe is a payments platform with strong primitives. You can build almost any billing model. You’ll also own more of the system.

- Paddle is optimized for SaaS selling globally with Paddle acting as merchant of record. You trade control for less compliance work.

- Chargebee is a billing layer that sits on top of payment gateways (often Stripe). It’s built for subscription operations, finance workflows, and complex catalogs.

Insight: The platform that feels “more flexible” on day one often becomes “more surface area” by month six.

Below is a direct comparison you can use in a decision doc.

Comparison table: Stripe vs Paddle vs Chargebee

| Dimension | Stripe | Paddle | Chargebee | |---|---|---| | Best fit | Product led SaaS that wants control and custom billing logic | SaaS selling internationally without building tax and compliance ops | SaaS with complex subscription catalog, finance ops, and multiple plans add ons | | Merchant of record | No (you are) | Yes (Paddle is) | No (you are) | | Tax handling | Tools available, but you own decisions and setup | Typically handled as part of MoR model | Integrations and workflows, but you still own compliance | | Custom pricing models | Very strong, but you implement logic | Good for common SaaS patterns, less for exotic models | Strong catalog and rules, but can become configuration heavy | | Implementation effort | Medium to high depending on model | Lower for global selling basics | Medium to high, especially if you want clean finance processes | | Reporting and finance workflows | Solid, often needs custom data pipeline | Good for payouts and MoR reporting | Strong subscription analytics, invoicing workflows, dunning controls | | Risk profile | Engineering complexity and webhook orchestration | Vendor constraints, less control over checkout and some flows | Operational complexity, configuration sprawl | | Typical “gotchas” | Webhook ordering, proration edge cases, custom invoice needs | Less flexibility for bespoke flows, MoR constraints | Over modeling plans, hard to simplify later |

Stripe: control, composability, and engineering ownership

Stripe is usually the default for teams that want to build billing as a product capability.

What tends to work well:

- You need custom checkout flows

- You want tight coupling between product entitlements and billing state

- You expect pricing experiments (and you want to implement them in code)

Where teams trip:

- They treat Stripe as a database. Then webhooks arrive out of order.

- They implement proration rules twice (once in Stripe settings, once in app logic).

- They don’t build an internal ledger of subscription state.

Mitigations we use in delivery:

- Define a single source of truth for entitlements (usually your app)

- Store Stripe IDs, but never rely on “fetch latest” as your only state

- Build idempotent webhook handlers with replay capability

Example: When we build SaaS products like Teamdeck, the recurring work isn’t the initial subscription setup. It’s the long tail: plan changes, access rules, and reporting that stays consistent across versions.

Paddle: move compliance out of your org chart

Paddle is compelling when you want to sell globally but don’t want to become an expert in tax compliance this year.

What tends to work well:

- Early stage SaaS with international customers from day one

- Small teams without finance operations

- You want a simpler path to VAT and GST handling

Where teams trip:

- They assume MoR means “no billing work.” You still need entitlement logic.

- They hit constraints on bespoke checkout or pricing edge cases.

- They underestimate how MoR affects refunds, invoicing, and customer support scripts.

Practical mitigation:

- Write down your support playbooks for refunds and disputes early

- Model “who is the seller” in your product emails and invoices so customers aren’t confused

Insight: Merchant of record reduces compliance burden, but it also changes your customer relationship. Make sure your support team is ready for that.

Chargebee: subscription operations and finance friendly workflows

Chargebee shines when billing is not just engineering work. It’s also finance, sales ops, and customer success.

What tends to work well:

- Multiple plans, add ons, coupons, contract terms

- Sales assisted billing with invoices and approvals

- Finance wants better control over catalog and dunning

Where teams trip:

- They build a catalog that mirrors every sales exception. Then it becomes unmaintainable.

- They rely on configuration instead of clear pricing policy.

- They underestimate integration work across CRM, data warehouse, and support tools.

Mitigation:

- Limit plan variants. Push exceptions into contract terms, not new SKUs.

- Treat the catalog as a product. Version it and review changes.

Key Stat (hypothesis): The more plan variants you have, the more billing related support tickets you’ll see. Track ticket volume per plan and per discount type.

How to choose: a decision framework you can actually use

If you’re stuck between Stripe vs Paddle vs Chargebee, stop comparing feature checklists. Start with constraints.

Pick Where Complexity Lives

Control vs compliance vs ops

The real comparison is not features. It is who owns the pain.

- Stripe: strong primitives. You can model almost anything. You also own more: billing state, retries, proration rules, tax wiring, and webhook correctness.

- Paddle: merchant of record. Less tax and compliance work. You give up some control over flows and edge case handling.

- Chargebee: billing and finance layer on top of gateways (often Stripe). Good for catalogs, invoicing workflows, and finance ownership. Adds configuration surface area and another system to debug.

Watch the trap: what feels “flexible” in week one can become “more surface area” by month six. Decide based on your next 12 months of pricing changes, not your current sprint.

Here are the constraints that matter most:

- Do you need merchant of record?

- Is your pricing model stable, or will it change every month?

- Who owns billing day to day: engineering, finance, or a hybrid?

- Do you need sales led invoicing workflows?

A practical way to decide is to score each platform against your next 12 months, not your current sprint.

Insight: Your billing platform should match your org shape. If finance will own pricing rules, give them tools. If product will run experiments, keep it in code.

Use the subsections below as a filter.

Quick pick rules (not perfect, but useful)

Pick Paddle if:

- You sell globally early

- You don’t want to build tax compliance operations

- You can live with some constraints in checkout and flows

Pick Stripe if:

- You want maximum control

- You have engineering bandwidth for billing edge cases

- You expect custom pricing and entitlements

Pick Chargebee if:

- You need subscription operations at scale

- You have finance and sales workflows that can’t live in code

- You want to separate payment gateway choice from billing logic

If you’re still unsure, do a small spike:

- Implement one paid plan

- Implement one upgrade with proration

- Implement one failed payment dunning scenario

- Implement an invoice export for finance

Whichever platform makes these four tasks simplest for your team is usually the right call.

What to measure during evaluation (so it’s not vibes)

If you can’t decide, run a two week evaluation and measure:

- Time to implement: checkout, subscription lifecycle, webhook handling

- Number of custom code paths you had to add

- Number of manual steps for finance (refunds, invoices, tax)

- Support readiness: can you explain a refund and invoice to a customer in two sentences?

Key Stat (hypothesis): If your evaluation requires more than 3 custom background jobs for billing reconciliation, you’re likely underestimating operational complexity. Track job count and failure rate.

processSteps

Two week evaluation plan:A fast way to de risk Stripe vs Paddle vs Chargebee

- Implement one plan end to end

- Add upgrade and downgrade with proration

- Simulate failed payments and recovery

- Generate an invoice export finance can use

- Run a refund and chargeback drill with support

- Review what required custom code vs configuration

Implementation strategies that keep you out of trouble

Most billing incidents we debug are not “Stripe is down.” They’re “our system processed the same webhook twice” or “we granted access before payment was confirmed.”

Billing Breaks on Edge Cases

Product decisions become invoices

Billing rarely fails because Stripe is down. It fails when product rules hit messy reality:

- Pricing changes mid contract

- Seats fluctuate daily

- Usage events arrive late or out of order

- “Cancel” has multiple meanings (end of term vs immediate vs downgrade)

- Discounts do not reconcile with finance

- Tax starts to matter once you sell outside one country

Hypothesis to verify: billing work quietly becomes 10% to 20% of engineering time after the first pricing iteration. Tag tickets touching billing, invoices, payments, or tax. Track support volume tied to failed payments and refunds. Rule of thumb: if it is product logic, keep it in code. If it is compliance logic, push it to a vendor. Write down 5 edge cases now and see which platform makes them boring.

Below are patterns we treat as baseline in end to end software development.

You’ll see echoes of our post MVP scaling advice here too: do things that don’t scale early, but don’t let them become permanent.

Actionable strategies:

- Keep billing logic behind a service boundary

- Make every webhook handler idempotent

- Reconcile billing state on a schedule

- Treat pricing changes as migrations

Example: In fast delivery projects like Miraflora Wagyu, speed comes from tight scope and clean interfaces. Billing is the same. Define the boundary early, even if the first version is simple.

A pragmatic rollout plan (works for Stripe, Paddle, or Chargebee)

Define your billing entities

- Customer

- Subscription

- Plan and add on

- Entitlement

- Invoice and payment

Decide what your app owns

- Entitlements and access checks should live in your app

- Payment status can come from the provider, but persist it

Implement the critical flows first

- New subscription

- Upgrade and downgrade

- Cancel at period end

- Refund

- Failed payment and recovery

Add observability

- Log every webhook

- Store correlation IDs

- Alert on mismatched states

Prepare for migration

- Abstract provider specific logic

- Keep a mapping of internal IDs to provider IDs

Here’s a webhook handler shape we use as a starting point:

// Pseudocode: idempotent webhook processing

async function handleWebhook(event) {

const id = event.id

// 1) Deduplicate

if (await db.webhookEvents.exists(id)) return {

ok: true

}

await db.webhookEvents.insert({

id,

type: event.type,

receivedAt: new Date()

})

// 2) Validate signature and parse

const payload = verifyAndParse(event)

// 3) Apply state change in a transaction

await db.transaction(async (tx) => {

await applyBillingUpdate(tx, payload)

await tx.auditLog.insert({

source: 'billing',

eventId: id,

payload

})

})

// 4) Trigger side effects asynchronously

await queue.enqueue('sync-entitlements', {

customerId: payload.customerId

})

return {

ok: true

}

}If you’re migrating from no code or low code, be careful here. Billing workflows often start as platform automations. Then you hit platform limits. The safest path is to migrate in layers: keep the provider, move the logic into code, then simplify.

Failure modes and mitigations

Common failures:

- Duplicate webhooks create duplicate invoices or access grants

- Proration math doesn’t match what customers expect

- Support can’t explain an invoice line item

- Usage events arrive late and bill the wrong period

Mitigations:

- Use idempotency keys everywhere

- Store a local ledger of billing events

- Add an internal “invoice explainer” view for support

- For usage billing, define the event time source and stick to it

Insight: If support can’t explain a bill, customers assume fraud. That’s not a product issue. It’s a trust issue.

_> Apptension delivery context

Relevant constraints we’ve shipped under

<a href="/case-study/marbling-speed-with-precision-serving-a-luxury-shopify-experience-in-record-time">Miraflora Wagyu</a> timeline

Custom Shopify experience delivered fast

Expo Dubai visitors

Virtual platform scale reference

<a href="/case-study/expo-dubai">Expo Dubai</a> timeline

Large build with many moving parts

benefits

What “good billing” looks like in production:Observable outcomes, not promises

- Support can explain every invoice line item in plain language

- Finance can reconcile payouts without manual joins

- Engineers can replay webhooks without fear

- Plan changes don’t require a data cleanup sprint

- Customers trust the checkout and renewal experience

Conclusion

Stripe vs Paddle vs Chargebee isn’t about which logo is bigger. It’s about where you want complexity to live.

- Stripe pushes complexity into engineering, but gives you control.

- Paddle pushes complexity into the vendor, but constrains some flows.

- Chargebee pushes complexity into operations and configuration, but makes finance and sales workflows easier.

If you want the simplest next step, do this:

- Write down your next 3 pricing changes you expect this year

- Write down your first 3 countries you’ll sell into

- Decide who owns billing day to day

- Run a spike that covers upgrade, failed payment recovery, and invoice export

Then pick the platform that makes those scenarios boring.

Example: When we built a virtual platform for Expo Dubai scale, the lesson was simple: systems fail at the seams. Billing has seams too. Design them on purpose.

Takeaways you can act on this week:

- Keep entitlements in your app, regardless of provider

- Design for migration even if you never migrate

- Measure billing work in engineering time and support tickets

- Limit plan variants before they limit you

A final checklist before you commit

- Can we implement proration without surprises?

- Can finance reconcile payouts and invoices without spreadsheets?

- Can support explain a refund and a chargeback process?

- Can we export subscription history for a customer on request?

- Do we have a plan for tax and compliance as we expand?

If you can answer those, you’re in good shape.

faq

Common questions teams ask before choosing

- Do we need merchant of record?

- If you’re selling globally without tax ops, Paddle can reduce risk. If you need full control, Stripe or Chargebee plus a tax setup may fit better.

- Can we start with Stripe and move later?

- Yes, but only if you keep a billing domain layer and don’t bake provider assumptions into entitlements.

- Is Chargebee overkill for an MVP?

- Often, yes. But if you’re already sales led with invoices and approvals, it can save time.

- What should we test first?

- Upgrade, downgrade, failed payment recovery, and invoice export. Those expose the real complexity.