Introduction

Most teams do not fail because they picked a bad SaaS tool. They fail because they picked a tool that does not match how they work.

You can buy a best in class CRM and still lose deals if your pipeline is a mess. You can roll out a shiny analytics stack and still argue about numbers if tracking is inconsistent. Sound familiar?

In our work building SaaS products and internal platforms, the pattern is consistent: the tool choice matters, but the integration, ownership, and measurement matter more.

Here is what this article covers:

- A comparison of common SaaS categories and top tools

- Where each tool tends to shine, and where it hurts

- A selection process you can run in one or two weeks

- Implementation notes based on how we ship software in practice

Insight: If you cannot describe the workflow you want in five steps, you are not ready to buy a tool. You are about to buy ambiguity.

What we mean by “best”

Best usually means one of these:

- Fastest time to value for a specific team

- Lowest total cost of ownership after 12 months

- Best fit for your constraints (security, compliance, budget, headcount)

This article treats “best SaaS tools” as “best fit tools,” with tradeoffs called out.

A quick note on metrics

Some claims below are backed by numbers we have seen in delivery work. Others are hypotheses. When it is a hypothesis, we say so and suggest what to measure.

Key Stat: The no code market was projected to reach $52B by 2024. That growth is real, but it does not remove the usual constraints: data ownership, integration complexity, and long term maintainability.

featuresGrid

What to compare (beyond the feature list):Use this grid during shortlisting

- Identity and access: SSO, SCIM, roles, audit logs

- Data: export path, API limits, retention, ownership

- Integrations: webhooks, retries, idempotency, native connectors

- Governance: permissions, approval flows, change history

- Reporting: metric definitions, dashboard sharing, segmentation

- Cost: pricing levers that scale badly (contacts, events, seats)

- Operability: monitoring, alerting, incident workflows

How SaaS tool choices go wrong (and how to spot it early)

Tool comparisons often skip the messy part: adoption. Most “bad tools” were never actually implemented.

Common failure modes we see:

- Buying for features you will not use in the next 90 days

- Letting pricing tiers dictate architecture (instead of the other way around)

- No owner, no training, no enforcement, then blaming the tool

- Treating integrations as a checkbox, not an engineering project

- Measuring activity (logins, seats) instead of outcomes (cycle time, conversion)

Insight: The biggest cost is not the subscription. It is the operational drag when the tool becomes another place where truth goes to die.

The hidden tax: integration and data drift

If your SaaS tools do not share identifiers, you will end up with duplicates, mismatched attribution, and manual exports.

Watch for these early warning signs:

- “We will clean the data later” becomes a recurring meeting

- Every team has its own dashboard

- The same customer appears under different emails across tools

Mitigation that actually works:

- Pick a source of truth for customer identity (often CRM)

- Define a minimal event taxonomy (10 to 20 events, not 200)

- Set a weekly data quality check with clear ownership

No code and low code: useful, but not free

No code and low code can be a great way to validate workflows. But the limitations show up fast when:

- You need custom permissions or complex roles

- You need reliable, testable integrations

- You hit performance constraints

- You need to own the data model long term

A practical compromise we use:

- Prototype the workflow in a no code tool

- Prove adoption and ROI

- Then decide whether to keep it, harden it, or rebuild it as part of a SaaS product or internal platform

Example: This mirrors the “do things that do not scale” phase we often see post MVP. Quick hacks are fine early. The mistake is pretending they are a long term operating model.

Comparison of the best SaaS tools by category

There is no single list that fits everyone. So we are going category first. Then we compare a few strong options per category.

Two week selection process

Pilot with real data

Avoid the two traps: months of debate or a one day purchase. Run a tight process:

- Write the workflow

- Set 30, 60, 90 day success metrics

- Shortlist 2 to 3 tools

- Time box a pilot using real data

- Decide, then implement with enforcement

Artifacts that prevent rework:

- One page requirements doc

- Data map (what data lives where)

- Rollout plan with named owners

Example pilot metrics for support (adjust as needed): first response time under 2 hours, time to close down 20% (hypothesis), deflection 10%, CSAT above 4.5/5.

Use this as a shortlist, not a verdict.

Quick comparison table

| Category | Tool | Best for | Watch outs | Typical time to get value |

|---|---|---|---|---|

| CRM | HubSpot | Fast setup, marketing and sales alignment | Costs rise with contacts and add ons | 2 to 6 weeks |

| CRM | Salesforce | Complex sales orgs, deep customization | Admin overhead, slow if over customized | 2 to 4 months |

| Support | Zendesk | Mature ticketing, workflows | Can get rigid, add ons pile up | 2 to 4 weeks |

| Support | Intercom | Conversational support, onboarding | Pricing can surprise at scale | 2 to 4 weeks |

| Analytics | GA4 | Basic web analytics | Harder governance, sampling and limits | 1 to 2 weeks |

| Analytics | Mixpanel | Product analytics, funnels, retention | Needs clean event design | 2 to 6 weeks |

| Analytics | Amplitude | Deeper analysis, experimentation | Steeper learning curve | 4 to 8 weeks |

| Data and BI | Looker | Governed metrics, semantic layer | Modeling effort, cost | 1 to 3 months |

| Data and BI | Metabase | Fast dashboards, lower cost | Governance and scale limits | 2 to 6 weeks |

| Project tracking | Jira | Engineering heavy orgs | Easy to over process | 2 to 4 weeks |

| Project tracking | Linear | Product and engineering speed | Less enterprise plumbing | 1 to 3 weeks |

| Docs and wiki | Notion | Flexible docs, lightweight ops | Permissions and structure can get messy | 1 to 2 weeks |

| Docs and wiki | Confluence | Enterprise wiki, auditability | Heavy feel, adoption friction | 3 to 6 weeks |

| Auth | Auth0 | Fast auth, many integrations | Pricing at scale, vendor lock in | 1 to 4 weeks |

| Auth | Clerk | Modern dev experience | Not ideal for every enterprise setup | 1 to 3 weeks |

| Observability | Datadog | Unified monitoring | Cost management required | 2 to 6 weeks |

| Observability | Sentry | App errors and performance | Not a full infra suite | 1 to 3 weeks |

What to take from the table:

- “Time to value” assumes you have an owner and a rollout plan

- The “watch outs” are where teams usually get stuck

Key Stat: A common failure pattern we see is paying for 20 seats and using 3. That is not a tool problem. That is an ownership problem. Measure active users weekly, not purchased seats.

CRM: HubSpot vs Salesforce (and when neither is right)

HubSpot is usually the fastest path to a working CRM with marketing and sales in the same place. It is a good default when the team wants to move quickly and the sales process is not wildly complex.

Salesforce is powerful when you need deep customization, complex permissions, and enterprise reporting. It also makes it easy to build a fragile monster if every department gets its own custom object.

A practical decision filter:

- Choose HubSpot if you need speed, simple pipelines, and marketing automation in one system

- Choose Salesforce if you have multiple sales motions, complex quoting, or strict governance needs

- Choose neither if you cannot commit an admin and a clear process owner

What to measure in the first 60 days:

- Percentage of deals with next step and close date

- Median time from lead created to first contact

- Forecast accuracy (hypothesis: improves only after you enforce stage definitions)

Support: Zendesk vs Intercom

Zendesk is ticketing first. It works well for structured queues, SLAs, and multi agent workflows.

Intercom is conversation first. It shines when support blends into onboarding, product education, and proactive messaging.

Tradeoffs we see:

- Zendesk tends to win on process and reporting

- Intercom tends to win on customer experience and speed

Risks and mitigation:

- If you pick Intercom, set strict rules for when a “conversation” becomes a “ticket” so issues do not disappear

- If you pick Zendesk, invest in macros and routing early or you will drown in manual triage

Analytics: GA4 vs Mixpanel vs Amplitude

GA4 is fine for marketing level web analytics. It is not a product analytics tool in the way most SaaS teams need.

Mixpanel and Amplitude are closer to how product teams actually work: funnels, retention, cohorts, and behavior.

A simple way to decide:

- If you mostly care about acquisition channels and site behavior, start with GA4

- If you need feature adoption, retention, and activation, use Mixpanel or Amplitude

The real work is not the tool. It is the event design.

Insight: If you cannot answer “what is activation” in one sentence, your analytics tool will not save you.

processSteps

A two week SaaS tool pilot plan:Short enough to finish, strict enough to learn

- Day 1 to 2: Write the five step workflow and success metrics

- Day 3: Configure SSO, roles, and baseline settings

- Day 4 to 6: Integrate one real data source (CRM, product events, support inbox)

- Day 7 to 10: Run the workflow with one team, capture friction daily

- Day 11 to 12: Review metrics, data quality, and edge cases

- Day 13: Decide and write the rollout plan

- Day 14: Kill the losing option and archive the learnings

A selection process that does not waste a quarter

Most teams either overthink tool selection for months or buy something in a day. Both are expensive.

Adoption failure patterns

What breaks first

Most “bad tools” were never implemented. Common failure modes:

- Buying features you will not use in the next 90 days

- Letting pricing tiers dictate architecture

- No owner, no training, no enforcement

- Treating integrations like a checkbox (they are an engineering project)

- Measuring activity (logins, seats) instead of outcomes

Metric to track weekly: active users vs purchased seats. If you pay for 20 seats and use 3, that is an ownership problem, not a vendor problem.

Here is a process that tends to work.

- Write down the workflow in plain language

- Define success metrics for 30, 60, 90 days

- Shortlist 2 to 3 tools max

- Run a time boxed pilot with real data

- Decide, then implement with enforcement

Key artifacts to produce:

- A one page requirements doc

- A data map (what data lives where)

- A rollout plan with owners

Example success metrics for a support tool pilot - First response time: target under 2 hours during business hours - Time to close: reduce by 20% (hypothesis) - Deflection rate: target 10% via help center and macros - CSAT: keep above 4.5/5What to include in a one page requirements doc

Keep it short. Force clarity.

- Primary users (names, not roles)

- Top 5 jobs to be done

- Non negotiables (SSO, audit logs, data residency)

- Integrations you will ship in phase 1

- Reporting you need in month 1

Avoid this trap:

- Listing every feature you have ever wanted

Pick what you will actually implement.

Pilot design: make it hard to lie to yourself

A pilot should be small, real, and measurable.

- Use production like data, even if it is a subset

- Pick one team and one workflow

- Set a fixed end date

Insight: If the pilot cannot fail, it is not a pilot. It is a slow purchase.

What to measure during the pilot:

- Weekly active users

- Task completion time (before vs after)

- Error rates (missing fields, broken automations)

- Manual work created (exports, copy paste)

benefits

What “good” looks like after rollout:If you do not see these, revisit process and ownership

- People stop asking where the latest info is

- Handoffs get shorter and less emotional

- Reports match what teams see on the ground

- New hires learn the workflow in days, not weeks

- You can change the process without breaking everything

Implementation notes from real delivery work

Tool selection is half the job. Implementation is where the costs show up.

Stop buying ambiguity

Workflow before tools

If you cannot describe the workflow in five steps, pause the purchase. You are about to encode confusion into software. Use a quick readiness check:

- Write the workflow in plain language (who does what, in what order)

- Name the owner (implementation and enforcement)

- Define the first outcome to improve (example: cycle time, conversion, first response time)

Tool choice matters, but integration, ownership, and measurement usually decide whether the tool becomes leverage or drag.

In our end to end software development work, we usually treat SaaS tools like part of the product surface area. They need design, integration, and QA.

Typical implementation phases:

- Foundations: identity, permissions, data model

- Integrations: events, webhooks, ETL, alerts

- Workflows: routing rules, automations, templates

- Reporting: dashboards, definitions, governance

- Enablement: training, playbooks, enforcement

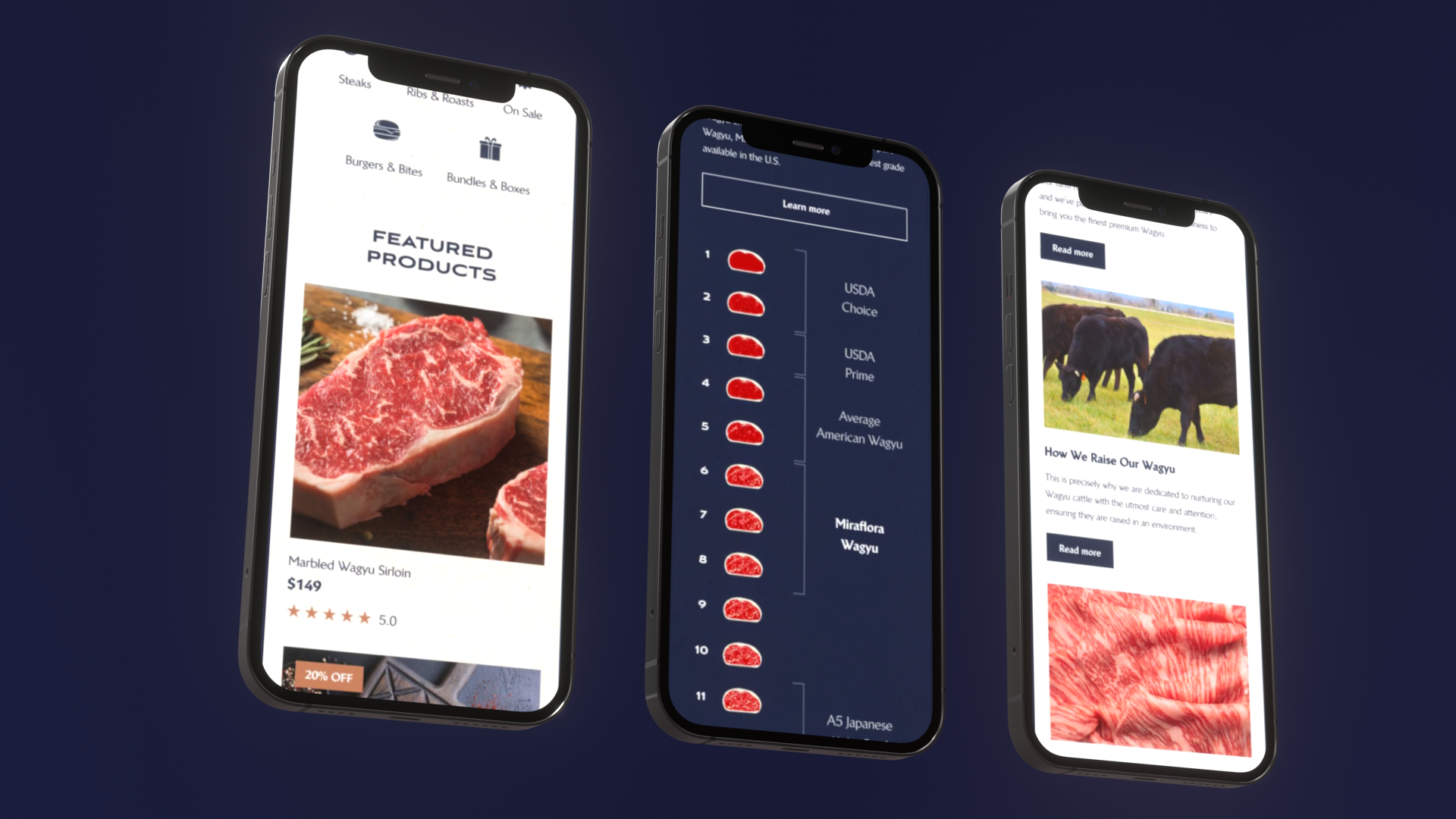

Example: On Miraflora Wagyu, speed mattered. The store shipped in 4 weeks. The constraint was not just engineering. It was coordination across time zones. Async communication was the difference between momentum and waiting.

Example: On ExpoDubai 2020, the scale and timeline changed everything. A platform that connected 2 million global visitors in 9 months forces you to think about observability, incident response, and performance from day one. Tools are part of that, but so are the habits around them.

What we learned building our own SaaS

Teamdeck is our own resource management and time tracking product. The product itself is not the point here. The lesson is.

- If internal teams do not trust the data, they stop using the tool

- If logging time takes too many clicks, compliance drops

- If capacity planning is not tied to delivery decisions, it becomes a spreadsheet export

That is why adoption metrics matter:

- Weekly active users by role

- Completion rate of the core workflow (for Teamdeck, time entries and allocations)

- Time to complete the workflow

A simple integration checklist

Before you roll out a tool, check these items:

- SSO and role mapping

- Audit logs (who changed what)

- Data export path (API limits, backups)

- Webhook reliability (retries, idempotency)

- Monitoring and alerting for critical automations

If you skip this, you will debug business processes at 2 a.m.

QA is not optional for SaaS setups

It is easy to treat SaaS configuration as “not code.” It still breaks.

Borrow a few habits from software testing:

- Version your configuration changes (even if it is just a changelog)

- Test critical workflows weekly (lead routing, ticket assignment, billing)

- Define acceptance criteria for automations

If you need a place to level up QA skills on the team, we have found that structured learning paths like ISTQB plus hands on practice work better than random videos.

_> Numbers worth keeping in mind

Context for tool choice and rollout risk

No code market projection

Projected value by 2024

<a href="/case-study/marbling-speed-with-precision-serving-a-luxury-shopify-experience-in-record-time">Miraflora Wagyu</a> timeline

Custom Shopify store delivery

ExpoDubai global visitors

Virtual <a href="/case-study/platform">platform</a> reach

faq

Common questions we hear during tool comparisons

- Should we standardize on one vendor for everything? Only if you have strong governance. Otherwise you will standardize on mediocrity.

- Do we need an admin role for every tool? For anything business critical, yes. If nobody owns it, it will rot.

- When is no code enough? When the workflow is simple, the data model is stable, and failure is cheap. If failure is expensive, treat it like software.

- How do we prevent tool sprawl? Limit pilots, enforce a kill rule, and keep a clear system of record per domain.

Conclusion

The best SaaS tools are the ones that fit your workflows, your constraints, and your ability to implement and maintain them.

If you want a practical next step, do this next week:

- Pick one category that causes daily friction (support, CRM, analytics)

- Write the workflow in five steps

- Define 3 metrics you will improve in 60 days

- Pilot 2 tools with real data

- Commit to one and implement it properly

Takeaways to keep:

- Ownership beats features. Name an owner before you buy.

- Integrations are engineering. Budget time and skill for it.

- Measure outcomes. Seats and logins are not the goal.

- Start simple, then harden. Early speed is fine. Just do not pretend it scales forever.

Insight: A tool cannot fix a broken process. But a clear process plus a decent tool can move surprisingly fast.

A final gut check question

If you removed this tool in 90 days, what would break?

If the answer is “nothing,” you do not have a tool. You have a subscription.