Introduction

Picking a CRM is not a branding exercise. It is an operating system decision.

In B2B SaaS, the CRM becomes the place where:

- pipeline reality beats pipeline optimism

- marketing handoffs either work or quietly rot

- renewals and expansions either have a process or rely on heroics

Salesforce, HubSpot, and Pipedrive can all “track deals”. The difference shows up when you try to scale.

Insight: The best CRM is the one that keeps your team honest, not the one with the longest feature list.

In this article, I will compare Salesforce vs HubSpot vs Pipedrive specifically for B2B SaaS growth. Not for generic sales teams. Not for ecommerce. Growth: lead to close, close to onboard, onboard to renew, and renew to expand.

What you will get:

- a clear comparison table

- where each tool shines, and where it breaks

- implementation steps that avoid common traps

- what to measure so this does not turn into a six month “CRM project”

What “growth” means in CRM terms

For most B2B SaaS teams, CRM requirements change right after product market fit. You go from “just close the next 10 deals” to repeatability.

That usually means you need:

- stage definitions that match your actual sales motion

- clean attribution (even if imperfect) for paid, outbound, and partners

- handoff visibility from sales to onboarding and customer success

- forecasting that is based on data, not vibes

If you cannot answer “what is stuck, where, and why” in under five minutes, your CRM is not helping.

- Early stage inbound motion: HubSpot

- Early stage outbound motion: Pipedrive

- Multi team enterprise sales: Salesforce

- Heavy compliance and permissions: Salesforce

- Marketing and sales shared workflows: HubSpot

- Simple pipeline discipline: Pipedrive

The real problem: CRM sprawl and process debt

Most CRM failures are not tool problems. They are process debt.

Teams start with a simple pipeline. Then add:

- one more lead source

- one more sales role

- one more region

- one more product tier

Now your “simple CRM” is a patchwork of fields, automations, and spreadsheets.

Common pain points we see when teams scale their SaaS delivery and internal ops:

- Sales stages mean different things to different reps

- Marketing and sales disagree on what a qualified lead is

- Customer success is blind until the contract is signed

- Reporting breaks because data entry is inconsistent

- Admin work grows faster than revenue

Key Stat (industry): 76% of consumers get frustrated when organizations fail to deliver personalized interactions. In B2B SaaS, that same frustration shows up as slow follow ups and messy handoffs.

The tool you pick either reduces this chaos or hides it until it is expensive.

- Salesforce is powerful, but it can become a full time job

- HubSpot is fast, but teams hit limits when they need deeper customization

- Pipedrive is simple, but it can turn into “CRM plus 12 add ons”

What to decide before you compare tools

Your motion matters more than features

Before you look at pricing pages, write down your sales motion in plain language.

Ask:

- Are you inbound led, outbound led, or mixed?

- Is your deal cycle 14 days or 140 days?

- Do you sell one product or multiple modules?

- Is onboarding complex enough to need a project plan?

Then decide what the CRM must do well.

A practical way to frame it:

- Capture leads from the channels you actually use

- Qualify with rules that marketing and sales both accept

- Sell with stages that map to buyer actions

- Deliver with a handoff that does not lose context

- Retain and expand with visibility into usage, health, and renewal risk

Insight: If you cannot describe your funnel in five stages or less, your CRM will not fix it. It will just store the confusion.

_> What to measure after you pick a CRM

If you cannot measure it, you cannot improve it

Time to first value

Closed Won to first meaningful product action

Weekly pipeline hygiene

Opportunities updated in the last 7 days

Forecast error target

Gap between forecast and actual bookings

Salesforce vs HubSpot vs Pipedrive: an honest comparison

Here is the comparison I wish more teams did upfront. Not “which has feature X”, but “what does it cost to run this well”.

Rollout sequence that sticks

Adoption first, automation second

Treat the CRM rollout like a software project. Use a short, enforced sequence:

- Define revenue model (ICP, deal types, contract terms)

- Map lifecycle (lead → opportunity → customer → renewal)

- Design the minimum data model (only fields used in decisions)

- Add automations after adoption is stable

- Lock reporting definitions (SQL, pipeline, churn)

- Integrate billing, product analytics, support (in that order)

Avoid: building for a future org chart, copying another company’s stages, and adding required fields without changing behavior. Data quality is a behavior problem first.

| Category | Salesforce | HubSpot | Pipedrive | |---|---|---| | Best fit | Complex sales orgs, multi product, heavy governance | Inbound and lifecycle teams that want speed | Small to mid sales teams that want simplicity | | Setup speed | Slow to medium | Fast | Fast | | Customization ceiling | Very high | Medium to high | Medium | | Reporting and forecasting | Strong, but depends on setup | Good out of the box | Basic unless extended | | Marketing alignment | Requires extra tooling and integration | Native strength | Usually external tools | | Admin overhead | High | Medium | Low to medium | | Risk pattern | Overbuilding, “CRM as a project” | Growing into limits, paying for hubs | Add on sprawl, data fragmentation |

Insight: The wrong CRM choice rarely fails on day one. It fails in month nine, when the team is bigger and the workarounds become the process.

Salesforce: when you need control and complexity is real

What Salesforce does well for B2B SaaS

Salesforce is the default choice when:

- you have multiple teams touching the same account

- you need strict permissioning and auditability

- your sales motion is not one pipeline, but many

- you expect heavy integrations (product usage, billing, support)

It is also strong when your reporting needs are serious and you have someone who can own the data model.

What fails:

- teams build custom objects and fields without a governance rule

- “one more automation” turns into brittle workflows

- adoption drops because reps spend too much time updating records

Mitigation that works:

- define a field ownership rule (who fills it, when, why)

- keep required fields to the minimum needed for forecasting and handoffs

- treat CRM changes like product changes: small releases, clear owners

HubSpot: speed, alignment, and a clean default path

HubSpot is the fastest way to get a working system for:

- inbound lead capture

- email sequences and basic automation

- marketing and sales alignment

- lifecycle reporting without a data team

It shines when you need teams to actually use the tool.

What fails:

- complex account hierarchies and edge case permissioning

- heavy customization that fights HubSpot’s defaults

- scaling cost as you add hubs and contacts

Mitigation that works:

- keep your first version close to HubSpot defaults

- push complex logic to a data layer (warehouse) if needed

- define a clear boundary between CRM and product analytics

Insight: HubSpot is great until you try to make it behave like Salesforce. Then you pay twice: in money and in friction.

Pipedrive: simple pipeline discipline, if you keep it simple

Pipedrive is a good choice when you want:

- fast setup

- pipeline visibility that reps like

- minimal admin work

- a tool that encourages consistent deal updates

What fails:

- teams try to run marketing, customer success, and support inside it

- reporting becomes “export to CSV” culture

- integrations multiply and data quality drops

Mitigation that works:

- keep Pipedrive focused on sales execution

- pick one source of truth for attribution and lifecycle reporting

- document integrations and field mappings early

Case note (observation): When teams outgrow Pipedrive, it is usually not because of the pipeline. It is because they need lifecycle visibility across sales, onboarding, and renewals.

- Week 1: Define stages, fields, and ownership rules

- Week 2: Configure pipelines, permissions, and basic dashboards

- Week 3: Implement handoff workflow and templates

- Week 4: Add one integration and run a data quality review

Implementation strategy that does not turn into a CRM rebuild

A CRM rollout is a software project. Treat it like one.

Compare operating costs

What it takes to run

Don’t compare CRMs by feature checklists. Compare by cost to run well.

- Salesforce: high control and customization. Fails when you overbuild and nobody owns governance. Plan for admin time and strict definitions.

- HubSpot: fast setup and strong marketing alignment. Fails when you hit model limits or start paying for multiple hubs. Mitigate by keeping lifecycle simple and auditing what you actually use.

- Pipedrive: reps adopt it fast. Fails via add on sprawl and fragmented data. Mitigate by limiting integrations and enforcing a small, stable data model.

Hypothesis to test: by month 3, measure admin hours per week, % deals with complete fields, and forecast variance. The “best” tool is the one that stays stable as headcount grows.

In our end to end software development work, the projects that go smoothly share a pattern: clear scope, short feedback loops, and measurable outcomes. CRM work is the same.

Here is a practical sequence that works across Salesforce, HubSpot, and Pipedrive.

- Define the revenue model (ICP, deal types, contract terms)

- Map the lifecycle (lead, opportunity, customer, renewal)

- Design the minimum data model (fields you truly need)

- Implement automations only after adoption is stable

- Lock reporting definitions (what counts as SQL, pipeline, churn)

- Integrate billing, product analytics, and support in that order

What to avoid:

- building a perfect system for a team you do not have yet

- copying another company’s pipeline stages

- adding required fields to “improve data quality” without changing behavior

Insight: Data quality is a behavior problem first. Automation is the second step, not the first.

A lightweight checklist for week one

The minimum viable CRM setup

If you want a CRM that supports B2B SaaS growth without heavy admin work, start with:

- 5 to 7 deal stages with clear entry and exit rules

- one definition each for MQL, SQL, and Closed Won

- a single owner per account and per opportunity

- a basic handoff template for onboarding

Then add only what you can maintain.

Here is a simple handoff template you can paste into your CRM notes field:

Onboarding handoff - Buyer role and champions: - Use case and success criteria: - Key integrations: - Timeline and constraints: - Risks we saw in the sales cycle: - Next meeting date and attendees:Hypothesis worth testing: if you standardize this handoff, time to first value drops. Measure:

- days from Closed Won to first key action

- number of onboarding meetings before activation

- first 30 day retention by segment

- Reps update deals weekly without being chased

- Marketing and sales agree on lead status definitions

- Onboarding starts with context, not guesswork

- Forecast calls reference the same numbers

- You can explain pipeline changes by segment and channel

Real world lessons from delivery: what scaling teams get wrong

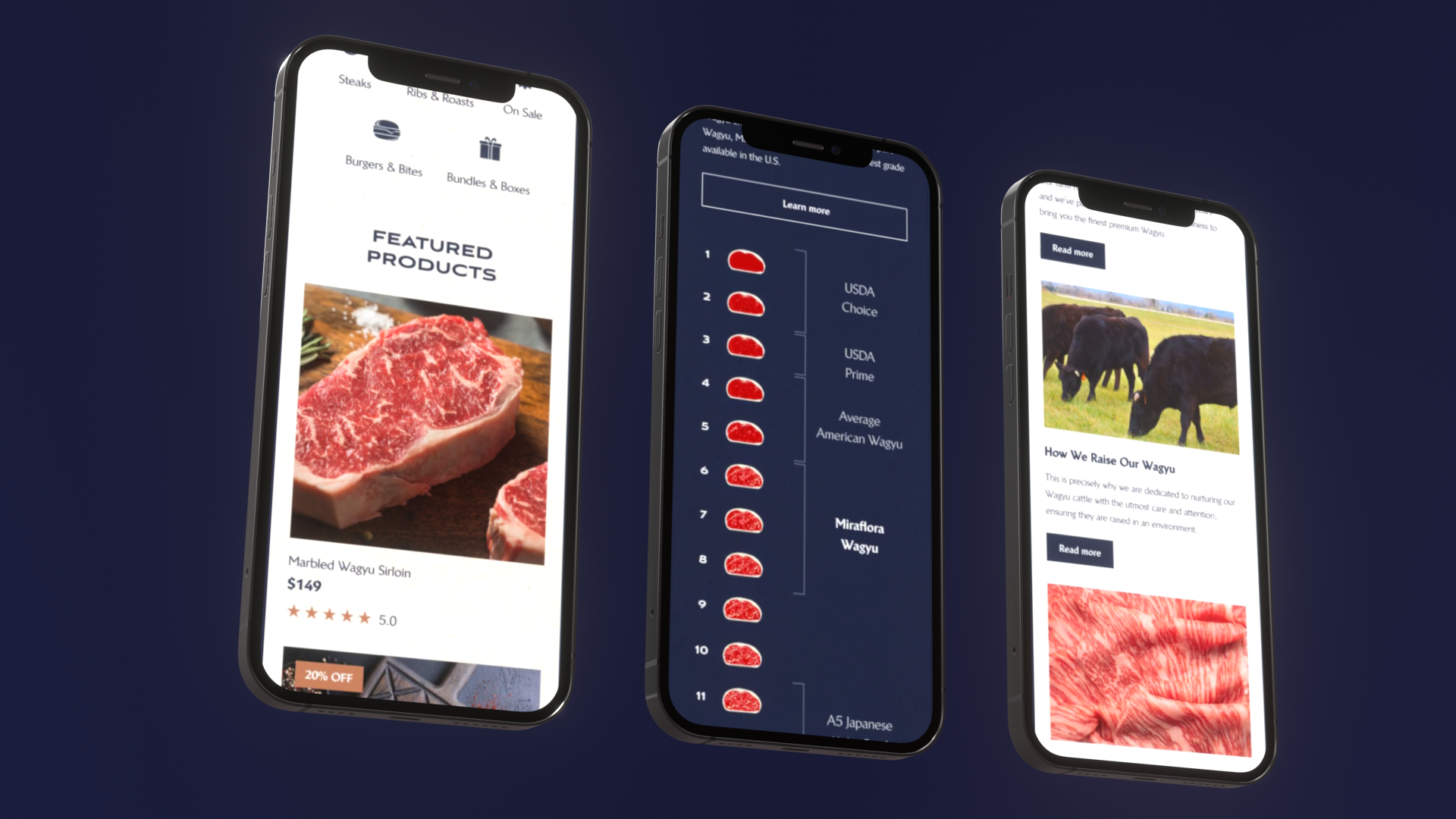

For Miraflora Wagyu, we delivered a custom Shopify store in 4 weeks. The hard part was not the storefront. It was feedback loops across time zones, with async communication as the default.

Diagnose process debt

Fix stages before tools

Most CRM breakdowns come from process debt, not missing features. Watch for these signals:

- Stage drift: the same stage means different things to different reps.

- Definition fights: marketing and sales disagree on what “qualified” means.

- Late visibility: customer success only learns context after signature.

- Reporting rot: inconsistent data entry makes dashboards meaningless.

Mitigation: write stage definitions in plain language, pick a single SQL definition, and remove fields that are not used in weekly reviews. The tool should reduce chaos, not hide it until month nine.

That maps directly to CRM rollouts. If your org is distributed, you cannot rely on “quick syncs” to fix process gaps.

What worked:

- clear async updates

- agreed definitions for what “done” means

- fewer moving parts

Example: In the Miraflora Wagyu project, time was the constraint. We kept scope tight, reduced back and forth, and shipped in weeks, not quarters.

Expo Dubai: scale changes what “good enough” means

How big platforms force you to formalize operations

Teamdeck is our own SaaS product for resource management and time tracking. Building internal tools teaches a blunt lesson: users ignore anything that adds friction without clear payoff.

That is why CRM adoption matters more than CRM features.

If you want better data, you need:

- fewer fields

- clearer reasons for each field

- workflows that match how people already work

Hypothesis worth testing: reducing required fields increases update frequency. Measure:

- percent of opportunities updated weekly

- median time between stage changes

- forecast accuracy vs last quarter

- Should we switch CRMs before or after hiring more reps? If you cannot enforce basic hygiene now, adding reps will amplify the mess. Fix definitions first, then scale.

- Can we start in Pipedrive and move to Salesforce later? Yes, but plan for data migration early. Decide what becomes the source of truth for accounts, activities, and attribution.

- Is HubSpot enough for customer success? For light CS workflows, sometimes. For complex renewals and multi product accounts, you may need a dedicated CS platform or a stronger data layer.

- How do we avoid “CRM as a project”? Ship in small releases. Tie each change to a metric like stage conversion, cycle time, or forecast accuracy.

Conclusion

Salesforce vs HubSpot vs Pipedrive is not a beauty contest. It is a tradeoff between control, speed, and simplicity.

If you want a clean rule of thumb:

- Pick HubSpot if you need fast alignment across marketing, sales, and lifecycle, and you can live with its opinionated model.

- Pick Salesforce if your complexity is real today (multiple products, regions, roles) and you will staff admin and governance.

- Pick Pipedrive if you want reps to update deals consistently and you will keep the scope tight.

What I would do next, regardless of tool:

- Write your stage definitions in plain language

- Decide your minimum required fields, then cut them in half

- Implement one handoff workflow from sales to onboarding

- Pick 3 metrics and review them weekly for 8 weeks

Those steps are boring. They also work.

Final insight: A CRM does not create discipline. It reveals whether you have it.